Who is on your Professional Divorce Team?

Every successful divorce case requires the execution of a professional team. So, who’s on yours?

A professional divorce team has a range of team players including the attorney, financial planner, accountant, appraiser, real estate agent and yes, a mortgage professional. Every team member has a significant role with ensuring the divorcing client is set to succeed post-decree.

As a Divorce Real Estate Collaboration Specialist, I help family lawyers and mediators complete the case file regarding secured house debt and homeownership eligibility through divorce mortgage guidance.

I am here to help you and your clients through the emotionally difficult process of navigating divorce and the real estate market at the same time - whether they are simply refinancing the marital home or selling and buying another.

Schedule a free 15-minute discovery call with me today to learn how I can provide value to you and your clients!

Let's Team Up To Create Your Professional Divorce Team

Hi, I'm PJ Byron of the Byron Mortgage Team

I help family lawyers and mediators complete the case file regarding secured house debt and homeownership eligibility through divorce mortgage guidance.

I provide detailed assessments of existing house debt, offer guidance on post-divorce homeownership prospects, and act as a conduit for effective communication between clients, legal representatives, and mortgage entities.

Behind every for sale sign is a story - and sometimes, the story is a sad tale of a marriage that didn't end happily ever after.

Working with divorcing couples is not just another mortgage transaction. There are specific nuances of working with divorcing clients as a mortgage professional. Have you considered how consulting with a trusted mortgage professional in the beginning stages of the case can make the post-decree financing requirements more successful and easy for your client?

Schedule a free 15-minute discovery call with me today to learn how I can provide value to you and your clients!

It takes TEAMWORK to bring the typical divorce settlement together

Nothing matters more in winning than getting the right people on the field. All the clever strategies and advanced technologies in the world are nowhere near as effective without great people to put them to work.

You want a mortgage professional on your team that understands the intricacies of your client's mortgage and can formulate a game plan for the secured housing financing needs of your clients.

I specialize in divorce mortgage lending and would appreciate the opportunity to speak with you about the value that I can bring to your professional divorce team.

My aim is to provide comprehensive information, enabling your client to make a well-informed decision. When you empower your divorcing clients with proactive strategies, defense meets offense. They deserve nothing less than the best approach for their situation.

I am in the business of helping people.

As daunting as the coordination required might seem, you can always count on me to manage the mortgage and real estate piece for your divorce team and divorcing clients.

This is what I do and I do it every day.

As a member of your Professional Divorce Team and a Divorce Real Estate Collaboration Specialist, it is my goal to:

Help both parties involved through a smooth yet emotionally difficult process when they need to sell the marital home and purchase new homes moving forward

Guide clients through the nuanced financial, legal, and emotional implications of selling the marital home and any other real estate

Offer alternatives to the usual mistrust and the emotional responses as a result of dividing real estate assets

Empower informed decisions for cash flow and equity management down the road

Mitigate emotional responses, fostering trust for optimal outcomes

Work with both parties to ensure a fair sale of the marital home, maximizing gains for the present and future

Help you complete the case file regarding secured house debt and homeownership eligibility through divorce mortgage guidance

Schedule a free 15-minute discovery call with me today to learn how I can provide value to you and your clients!

You Can’t Cut The House In Two...

There are 3 ways to divide a house:

Sell house and divide profits

One spouse buys out the other

Both stay on deed and sell later

The harsh reality...

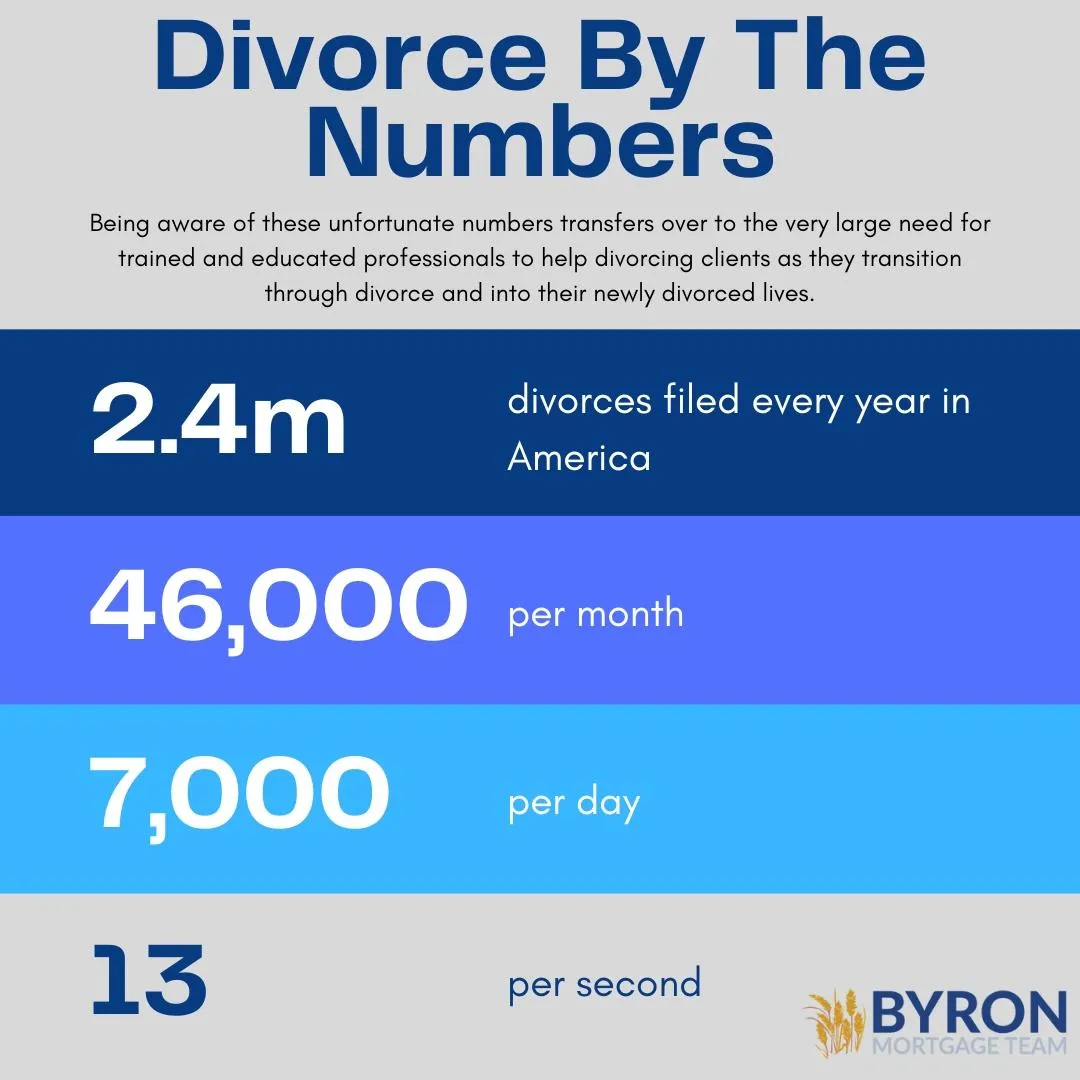

Currently there are 2.4 million divorces filed every year in America. That breaks down to over 46,000 per month and almost 7,000 per day. And one divorce is filed every 13 seconds. Now, I’m not an advocate for divorce; however, being aware of these unfortunate numbers transfers over to the very large need for trained and educated professionals to help divorcing clients as they transition through divorce and into their newly divorced lives.

When there is a marital home (or even other real estate) involved in a divorce situation, the same question almost always arises: “What should we do with the marital home?” Typically, many reasons to keep the home and many reasons to sell the home are present, and as the advisor, a neutral approach is needed to separate the emotion from the economics.

I am committed to providing information to you and your clients that will help them make the best decision for their unique circumstances. I have studied and I am certified in divorce specific information that can help them make the most informed decision regarding the real estate marital asset.

Why you Need a Real Estate Collaboration Specialist (RCS-D™️) on Your Professional Divorce Team:

A professional divorce team has a range of team players including the attorney, financial planner, accountant, appraiser, mediator and yes, a divorce lending professional.

Every team member has a significant role ensuring the divorcing client is set to succeed post decree. As a Certified Real Estate Collaboration Specialist - Divorce, I bring the financial knowledge and expertise of a solid understanding of the connection between Divorce and Family Law, IRS Tax Rules, and mortgage financing strategies as they all relate to real estate and divorce.

Having a RCS-D™️ on your professional divorce team can provide you the benefit of:

A RCS-D™️ is trained to recognize potential legal and tax implications with regards to mortgage financing in divorce situations.

A RCS-D™️is skilled in specific mortgage guidelines as they pertain to divorcing clients.

A RCS-D™️ is able to identify potential concerns with support/maintenance structures that may conflict with mortgage financing opportunities.

A RCS-D™️ is able to recommend financing strategies helping divorcing clients identify mortgage financing opportunities for retaining the marital home while helping to ensure the ability to achieve future financing for the departing spouse.

A RCS-D™️ is qualified to work with divorce professionals in a collaborative setting.

A RCS-D™️ can provide opportunities in restructuring a real estate portfolio to increase available cash flow when needed.

When the RCS-D™️ is involved during the divorce process and not after the fact, many potential financing struggles can be avoided with valuable and educated input.

As a divorce lending professional, I look forward to the opportunity to work with you and your divorcing clients as they explore their options for selling, refinancing or purchase new real estate.

What We Offer

Client-Centric

Information Gathering

Tailored advice and solutions for clients going through divorce proceedings.

Collaborating closely with legal professionals for holistic support.

Empowering individuals with expert insights for favorable outcomes.

Simplifying complex financial decisions during divorce settlements.

Comprehensive

Analysis & Recommendations

In-depth review of financial status and mortgage.

Providing recommendations aligned with legal strategies.

Conducting thorough assessments to provide comprehensive mortgage analyses.

Delivering comprehensive reports.

Presenting detailed insights to facilitate well-informed mortgage decisions.

Customized

Mortgage Solutions

Crafting tailored mortgage solutions to suit individual financial needs.

Personalizing mortgage strategies for diverse client requirements.

Designing custom mortgage plans aligned with specific financial goals.

Customizing mortgage plans to accommodate specific preferences.

Frequently Asked Questions

If you are curious why you should have a RCS-D™️ (Real Estate Collaboration Specialist- Divorce) on your professional divorce team, here are some common answers to frequently asked questions. Please feel free to reach out to me at any time with any additional questions, or schedule a time to talk to me one-on-one.

Q: What does RCS-D stand for?

A: Real Estate Collaboration Specialist- Divorce.

Q: Is this one of those fake Real Estate certifications?

A: No, this is a specialist designation rather than an expert certification. However, the faculty includes Prof. Murray, who holds degrees from both Stanford and Harvard Law School. With this specialized knowledge, we empower divorcing clients to make an informed decision.

Q: Who teaches the RCS-D course?

A: I was trained by Professor Kelly Lise Murray, J.D. co-founder of divorcethishouse.com. She holds a J.D. from Harvard Law, and A.B. from Stanford University, she is on the faculty of a top 20 law school - Vanderbilt Law School, and she has been a featured speaker at the National Collaborative Law Conference.

Q: What are the RCS-D 3 WHYs?

Protect credit score

Preserve homeownership eligibility

If they decide to refi, I hope to be considered for the transaction

Q: I already get a title search. How is this different?

A: Do your clients have any Home Equity Lines of Credit (HELOCs) or a mortgage payoff letter? Have they utilized COVID-19 forbearance options? What about solar liens?* We can delve into the intricacies of their mortgage, and take that task off your plate. Our aim is to provide comprehensive information, enabling your client to make a well-informed decision.

Q: How do you get paid?

A: There are no fees for this service for your clients. Under the ECOA marital status is a protected class, and under these guidelines I am legally not allowed to charge. So anyone meeting with me for a pre-approval or any divorce mortgage guidance is free. Since I cannot charge for this service, I simply ask that if one client keeps the house, I hope to be considered for the refinance, or if they decide to sell, my team members are considered for the listing. We recognize that not every case will result in a transaction, but we earn business by providing value.

Hi, my name is PJ Byron. I'm the Sales Director of the Byron Mortgage Team and Loan Officer - NMLS #24931 at First Class Mortgage NMLS #2038063, offering personalized mortgage solutions, fast customized quotes, great rates, and service with integrity.

SUPPORT

CONTACT INFO

420 Scrabbletown Rd, Unit B

North Kingstown, RI 02852

Copyright © 2024+ | The Byron Mortgage Team at First Class Mortgage | Company NMLS #2038063 | MA - Mortgage Broker lic #MB2038063 | RI - Loan Broker lic #20214228LB | ME - Loan Broker lic #2038063 | FL - Mortgage Broker lic #MBR6561 #FL0025448